Why Innovation Matters

Imagine a world where markets are so efficient there are no longer undervalued assets. Where you have too much capital, too few assets to chase, and impatient LPs. You have to overpay for every deal to win it. There are limited options to optimize the targets you find and limited room to juice returns with additional leverage. A world where LPs are also becoming competitors, demanding to co-invest or creating direct investment funds themselves. Where a portfolio company’s industry will almost certainly be disrupted during the hold, possibly more than once. Where the biggest competitors to your portfolio companies are not just market leaders or upstarts in the category, but coming from completely different industries altogether.

Welcome to that world.

The PE market is becoming ever more crowded as more and more firms sprout up to get into the game. As of 2018, there are almost 8,000 private equity groups, up from closer to 6,000 in 2012. New entrants are lured by the ample liquidity LPs are pumping into the market and loose debt markets: PE firms raised $714 billion globally in 2018 – a monumental $3.7 trillion was raised over the past five years – and average debt multiples have risen above 6x.1

This has led to an unprecedented amount of dry powder – $2.0 trillion in December of 2018 across all fund types – chasing a limited number of assets, which is fundamentally changing the dynamics of the deal. Average deal sizes continue to get bigger; multiples have continued to expand from 9.1x in 2008 to 10.9x in 2018. At the same time, it’s taking longer to exit, as only 20% of exits today are happening in less than three years (down from 40% in 2005). 2

While easy money can act as a catalyst for deals, soaring asset prices, fierce competition, and greater market uncertainty demand more discipline of investors. More discipline, as well as bigger and bolder thinking.

Historically, PE firms have largely relied on four moves to drive returns: 1) buy undervalued assets 2) lever up 3) drive operational efficiency and 4) reassess leadership and talent. While these elements remain a vital part of the playbook, they are insufficient to drive required returns today. Undervalued and underlevered assets are ever-harder to find, and more and more the investable universe has been previously owned by financial sponsors, diminishing potential for operational improvements.

In order to compete in this new world, PE firms cannot rely on their old playbooks. Rather, there is a greater need to transform the value of acquired assets, and this is exactly what we have seen our clients begin to do. Gone are the days of simply expanding into adjacent products and markets. Today, we see PE firms swinging for the fences in order to unlock this elusive growth.

In response to these shifting market dynamics, we have also seen shifts to fund structures, including a rise in MegaFunds (those with more than $5 billion represented 58% of deal activity in 2017) and a growing interest in long-hold funds (vehicles that intend to hold assets for 7+ years).3 These larger fund sizes and longer runways allow firms more flexibility to invest in and integrate add-on acquisitions, create larger platforms, and nurture more transformative innovations to fruition – something that was neither possible nor attractive when shorter hold periods were the norm.

Innovation as the Growth Lever

In these hyper-efficient markets, innovation is now a mission-critical piece of the PE playbook. After all, revenue growth is the most trusted, fundamental source of investment returns.

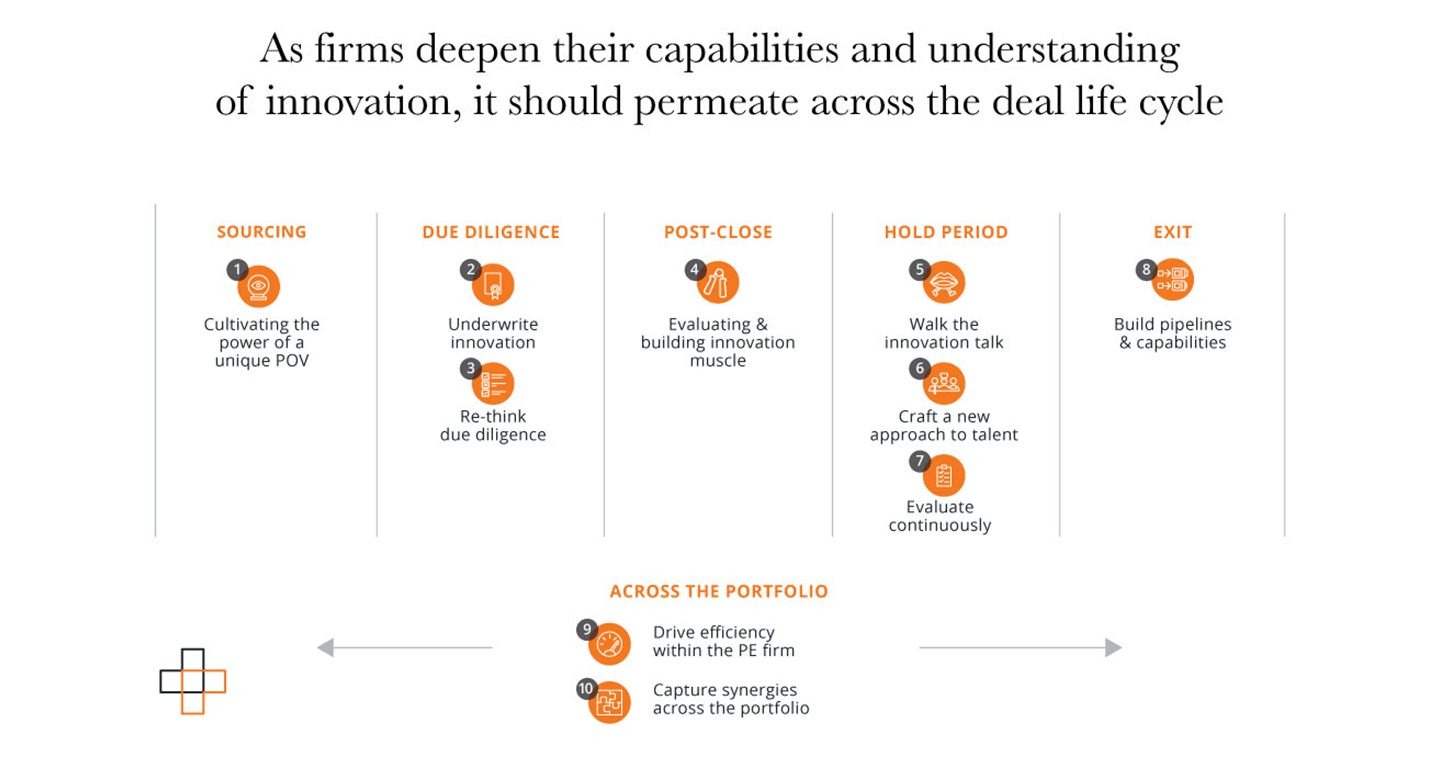

However, doubling down on innovation does not just mean creating new things during the hold period. As firms deepen their capabilities and understanding of innovation, they can go further to bring innovation into their processes more holistically. Doing so can help top-quartile PE firms both differentiate themselves from the competition and devise altogether new ways to create value.

All this points to a next-gen model you can call M&A&I. Mergers and Acquisitions and Innovation. Here are ten ways to accelerate and elevate innovation’s impact across the PE life cycle:

Cultivate the power of a unique point-of-view

Defining trends and a set of investment themes that grow out of them is table stakes. But as the table gets more crowded, winning requires something deeper – a unique point of view on the future. This is not a function of information, but of true insight, seeing something that your rival bidders cannot. Firms that become world class at anticipating second- or third-order effects that the market has not yet fully priced will have a better shot at finding proprietary deals, and knowing when to bid aggressively.

Underwrite innovation

Where that unique POV on the future gives you better vision, there’s a complementary practical element that makes that vision an active asset: learning how to build a layer of future innovation value into the nuts-and-bolts financial assessments that drive the bid. How do you analytically dissect the value of innovations that haven’t yet been created? Typically this is best done through analogs and proxies. Will this feel comfortable for deal teams who cut their teeth by parsing the thoroughly familiar and tangible columns of last year’s balance sheet? No. Because at the end of the day, this represents the cultivation of a valuable new capability: the high art of measuring the immeasurable to inform the investment thesis.

Re-think due diligence

When the risk of disruption – in digital form or any other – looms larger than any potential operational efficiencies, what should be the new role of diligence? By deploying new tools (digital and otherwise), firms can go much deeper in diligence and learn more quickly than ever before, opening up new ways to drive value prior to acquisition and identifying the strategy to deploy immediately afterwards to hit the ground running on the first day of ownership.

Evaluating and building innovation muscle

PE firms that begin underwriting innovation in their investment theses will quickly see a key dependency – that the probability of innovation delivering turbocharged growth is a function of the innovation talent, structures and processes that exist in the target company, or can be augmented through external help. A deep assessment of innovation capability requires face time with parts of the target company organization that are not readily accessible during a typical diligence cycle, so it’s critical that Operating Partners have a go-to rapid diagnostic process to activate immediately post close, understanding the company’s product development capabilities, and shaping action plans for strengthening that innovation muscle in real time.

Walk the innovation talk

Building innovation into the investment thesis lays the groundwork for creating high value topline growth. But by the time the ink on the deal is dry and the deal team is replaced by a front line operating team, the realization of that layer of innovation value is a function of walking the talk, defining and validating concrete innovations that unlock new value for customers and the business, and pulling the trigger on their launch. Innovation bets are rarely a lock, so here too is a need for the PE firm to get comfortable with the ambiguity and risk profile of driving top line growth, rather than the relative certainty of cost cutting and financial engineering.

Craft a new approach to talent

PE firms have long understood the importance of talent and have routinely installed new management teams in the companies that they operate. But this new world requires a new assessment of talent. Portfolio companies need to develop new expertise (digital and beyond) and GPs can help by creating talent and capabilities ecosystems on which portfolio companies can draw. Furthermore, while PE firms themselves have traditionally hired people with similar experiences, those who want an edge should look to benefit from the tension of diverse perspectives, backgrounds, and styles of thinking.

Evaluate continuously

The old playbook of setting the company strategy once at the acquisition date for the next five years no longer holds. Today’s firms need to be prepared for more frequent evaluation of the marketplace, being mindful that many of tomorrow’s competitors are not just upstarts that may not yet exist, but incumbents in other industries that are blurring category lines. This requires more frequent hunts for insights, interaction with experts, and iterative testing of growth assumptions. Sudden shifts in consumer taste can upend product mixes in a matter of months or weeks.

Build pipelines and capabilities

During the hold, PE firms need to ensure that they are not just growing, but also building a growth story and related pipeline that is inspiring for at least one (if not two) future PE cycles. Actively building product pipelines and ensuring that portfolio companies have the right capabilities and culture in place to continue driving innovation in the future will command a premium in the marketplace from buyers.

Drive efficiency within the PE firm

The digital transformation we are seeing across industries should be an impetus to re-evaluate the PE model itself. PE firms can look to incorporate digital tools to accelerate and improve their own internal processes — leveraging automated tools to compare deal model forecasts with actual results, analyzing new datasets to capture learnings across the portfolio that can be applied at scale, using AI to predict and notify of covenant breaches, and much more.

Capture synergies across the portfolio

As PE firms are looking to be more competitive with corporate strategic buyers, they should be looking not just at how to drive efficiencies within companies, but also among different companies within the portfolio.

As the competitive dynamics of the marketplace and economic uncertainty both become more challenging to navigate, private equity firms will need to evolve, retool, and retrench for a much different future. Developing a holistic strategy for innovation – from investing to portfolio management to group operations – will allow firms to confidently move forward as more nimble organizations that can identify unseen potential and quickly create untapped value.

1. Global Private Equity Report 2019, Bain & Company, Inc. 2019.

2. Global Private Equity Report 2019, Bain & Company, Inc. 2019.

3. Global Private Equity Report 2018, Bain & Company, Inc. 2018.

Courtney is Head of Strategy and Head of Private Equity. Prior to joining Fahrenheit 212, Courtney was a Vice President at Michel Dyens & Co in Paris, where she sourced and executed M&A transactions in the luxury, beauty, and spirits sectors internationally. Before that, she worked at Estin & Co, a strategy consulting firm in Paris, where she developed global growth and investment strategies for multinational clients across industries.

Matt is an Enagement Manager on the Strategy team. Matt brings experience in finance, consulting, and entrepreneurship to his role. Prior to joining Fahrenheit, Matt worked on the Impact Investing team at Arabella Advisors, a philanthropic consulting firm.

We respect your privacy

We use Cookies to improve your experience on our website. They help us to improve site performance, present you relevant advertising and enable you to share content in social media. You may accept all Cookies, or choose to manage them individually. You can change your settings at any time by clicking Cookie Settings available in the footer of every page. For more information related to the Cookies, please visit our Cookie Policy.