Money Worries: Why It's Time For Us to Address our Financial Wellbeing Crisis

“Money, get away / Get a good job with good pay and you’re okay” – Pink Floyd

“Anywhere you go it’s the same cry, money worries” – Bedouin Soundclash

“I don’t know what they want from me / it’s like the more money we come across / the more problems we see” – Notorious B.I.G

From rock stars to rappers, single mums to debt-laden students – it seems everyone worries and cares about money. Money is either freedom or pain, and for different people, rich or poor, the pain is real. Last year 40% of adults in the UK cited money as the primary reason for feeling stressed and anxious, while nearly 75% of 18-34 year olds have at some point experienced mental health or wellbeing issues linked to financial concerns. These facts are why governments, private enterprise and the third sector are paying more attention to ‘Financial Wellbeing’ and how our relationship with money affects how we feel, act and function on a daily basis.

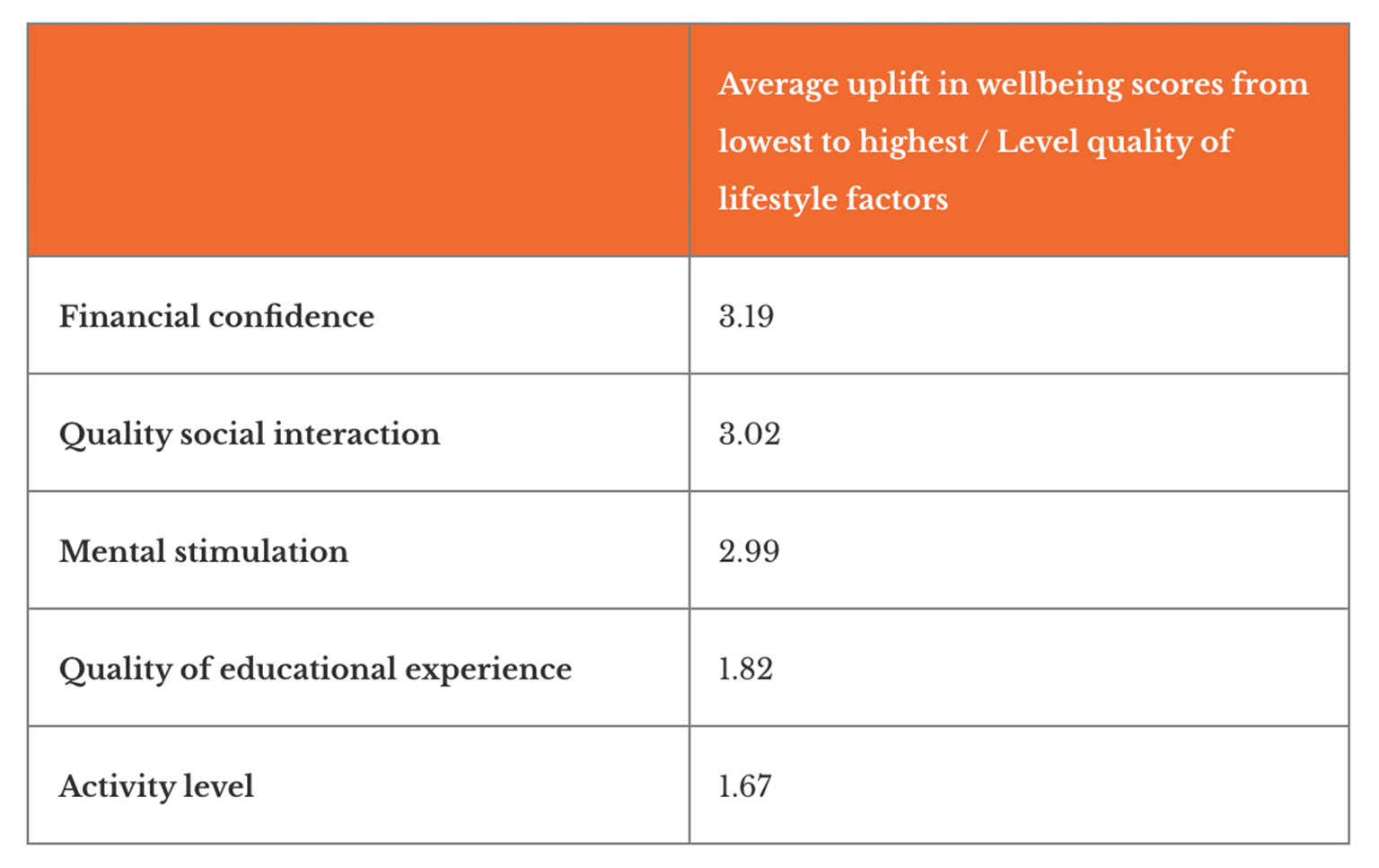

In fact, research comparing the relative impact of wellbeing indicators identifies ‘Financial Confidence’ as our biggest lever for improving wellbeing scores, nearly double that of increasing our level of exercise.

Source: YMCA, Eudaimonia: How do humans flourish (2016)

So what are the ways into this social challenge, and where are the opportunities for organisations to create new value? We have identified three groups for whom Financial Wellbeing is either at crisis point, or at risk of reaching this point soon.

#1 Adults in work – Managing cash flow and achieving life goals

A decade of stagnant real wage growth, public spending cuts, rising inflation and a changing labour market have been squeezing young adults in full time work. That’s before we even begin to think about the ‘squeezed middle’ of families struggling to make ends meet. The challenges facing this group are:

- Managing cash flow – this goes beyond tracking what’s coming in (salary, other earnings) and what’s going out (bills, travel, loans), and into forecasting where crunch points might come (unexpected bills, large one-off payments). In the UK, 33% of middle class families struggle with an unexpected £500 bill, and this figure is comparable for in work adults. One way in to this challenge is to foster a more informed approach to credit, when to use it and how to select an option that doesn’t lead to a spiral of unserviceable debt. The other is being signalled by employer / employee solutions like Wagestream (backed by Jeff Bezos and Bill Gates) and Hastee Pay, where employees can receive their earned pay immediately for a one-off charge, instead of having to wait to the end of the month, thereby avoiding potentially costly bank overdraft fees and high interest payday loans.

- Alternative credit scoring and widening access to financial products – this is currently a two-sided problem. On one hand retail banks use rigid risk management and credit scoring frameworks which filter out people in work who present a relatively low risk of defaulting, and pushes them to alternative forms of high interest, predatory lending. On the other hand, people in work are not playing the credit scoring game well enough to build a high credit score which would make them eligible for unsecured lending. The obvious solve is to change the rules (and deadweight loss to banks and consumers) by developing an alternative (and more progressive) approach to credit scoring. This could mean assessing a candidate based on past and predicted financial behaviour beyond credit (including transactions and savings behaviour). It could (and should) include factors like future earnings potential. The outcome would be fewer people caught in a cycle of high interest debt.

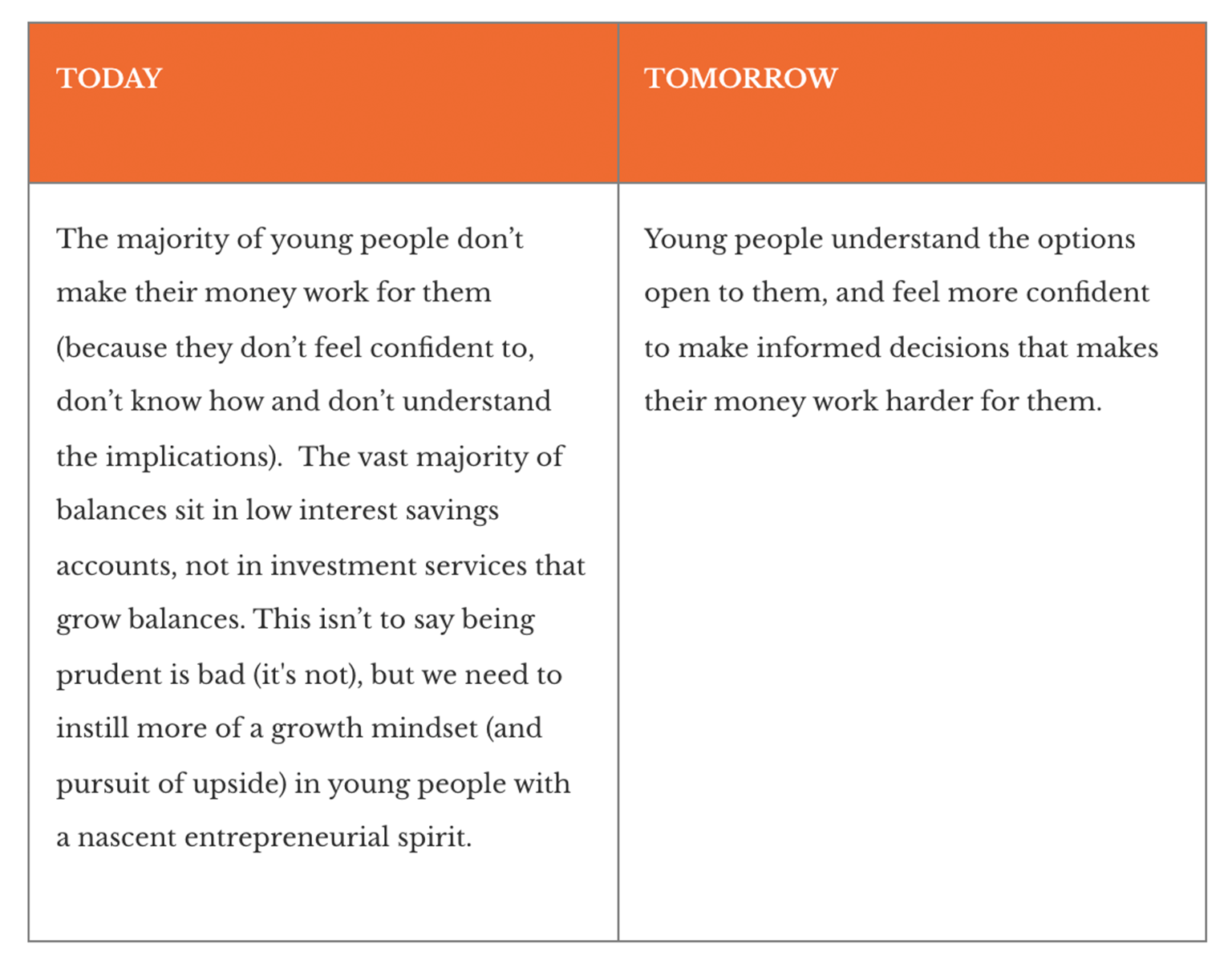

- Saving, investing and attaining ‘life goals’ – if saving for a housing deposit seems futile (because buying a property seems unachievable), what should this generation be saving for? The default position for many is to ‘put something away for a rainy day’. In a low interest environment this does nothing to further the interests of young savers, so organisations need to do better support and cultivate a growth mindset built around ‘making my money work for me’. Alternative forms of investment, like community investment, seed investing to support organisations that work for a purpose you believe in are great ways to engage consumers in a conversation around ‘doing more’ with their hard earned cash.

Attacking the other side of the problem, namely ‘savings defeatism’ is becoming more and more relevant. I caught up with Matthew Addison, CEO & Founder of StepLadder, who explained that he sees a huge opportunity in collaborative finance:

“by joining a group of peers and creating that essential social capital alongside financial capital we play a key role in reshaping the financial independence and success of today’s Generation Rent. We have built our offering centered on the belief that ‘together, we are stronger,’ which for StepLadder members should mean: better informed, better served and – crucially – more likely to attain those life goals, such as homeownership, that finance is supposed to enable.”

The next stage of evolution in this space will be integrating the different solutions outlined above (and a growing number of others) into a joined up, easy to understand proposition.

#2 Youth – Equipping young people with the tools for life

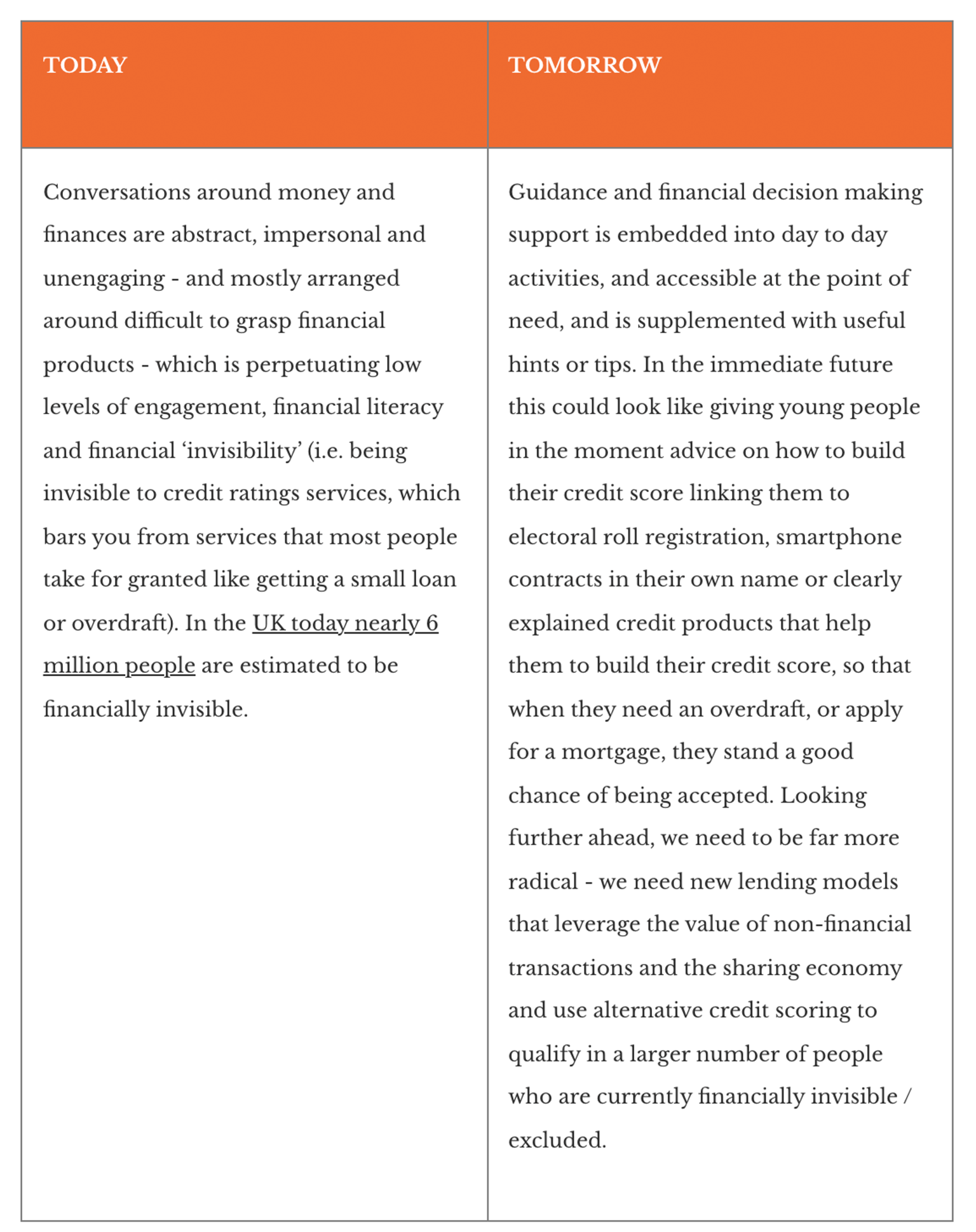

Like our genes, our financial knowledge, behaviours and mindsets are inherited. Some children are the beneficiaries of financial security and financial confidence that has accrued value across generations. Others are the inheritors of bad debt that shape negative, lifelong habits. Similarly, some young people are supported by their personal network to think about what they do with their money (and are equipped for the adult world), but sadly the vast majority are not and stubbornly low levels of financial literacy across OECD countries are more than enough evidence of this. So it is both an opportunity and obligation for financial institutions to address, but there are two significant barriers to overcome:

- The first is how to be relevant and useful to young people from a wider range of backgrounds, so that financial advice and support is available to more than just ‘high value’ families.

- The second is how to build financial confidence amongst today’s youth, so that they are equipped to make informed decisions.

So let’s look at what needs to be ‘flipped’:

In short, the opportunity for financial institutions with younger customers is win-win: support your young customers to make more informed decisions and you create higher customer lifetime value. For financial institutions right here, right now this means more than ‘financial education’, it means operating on the terms of young people and understanding their situation (as well as risk) in new ways.

#3 Older adults – Making the distant future of retirement more graspable

We are living longer. Healthcare costs are rising. Social security and adult social care cutbacks are biting and forced retirement is forecast to accelerate as automation increasingly substitutes older workforce participants across a range of industries. One thing is clear – we should prepare for life after work, or at least build an income to support part time work in old age. But quantifying how much we will need across a range of scenarios is difficult. Opportunity beckons in four areas:

- Personal goal setting– planning for the long term is made difficult if we are unable to see the impact decisions we make today will have on our world tomorrow. Personalised goal setting, supported by scenario planning tools that help us understand the impact of different choices, are making retirement planning more graspable. Vanguard are leading the charge in this space.

- Single view – over the course of years we accumulate and store things in different places, and this also goes for retirement savings. Finding, organising and managing these pots can get messy and will only get messier as we have more careers (now forecast to be nearly 11), and more of us work internationally. Which is why, not only better savings pot integration, but also a single view is becoming critical.

- Supporting mindset switching, from habituated accumulation (saving for retirement), to planned decumulation (withdrawing funds to live well when approaching retirement). For many customers who have spent a lifetime building a cushion, it is very difficult to withdraw the funds when they need them. It should be easy, no excuses. Time to fix it!

- Time is money – people approaching retirement (and working part time), or those who have retired suddenly have a lot more of a very scarce commodity: time. How can we use people’s time and willingness to perform valuable public services and reward this, so that retirees can continue to be valuable and participatory members of society, while simultaneously supporting themselves? Or looked at in another way, how could we accrue ‘retirement credit’ across a lifetime, by doing things that are valuable to society, that are redeemable upon retirement and help to support us into old age?

Achieving higher rates of return on our Financial Wellbeing

If we can attack these three big areas, across life stages, we will shift the dial on Financial Wellbeing and create new value for customers and the organisations serving them. At Fahrenheit 212 we have strong opinions on how to win and would like to talk to organisations with the initiative to grab them.

Max is an Engagement Manager in the Central Europe Commercial Strategy team, based in Munich. He thrives when helping his clients exploit their strengths to realize new growth opportunities and win in competitive markets.

We respect your privacy

We use Cookies to improve your experience on our website. They help us to improve site performance, present you relevant advertising and enable you to share content in social media. You may accept all Cookies, or choose to manage them individually. You can change your settings at any time by clicking Cookie Settings available in the footer of every page. For more information related to the Cookies, please visit our Cookie Policy.